Notes before 1987 vs. 2023

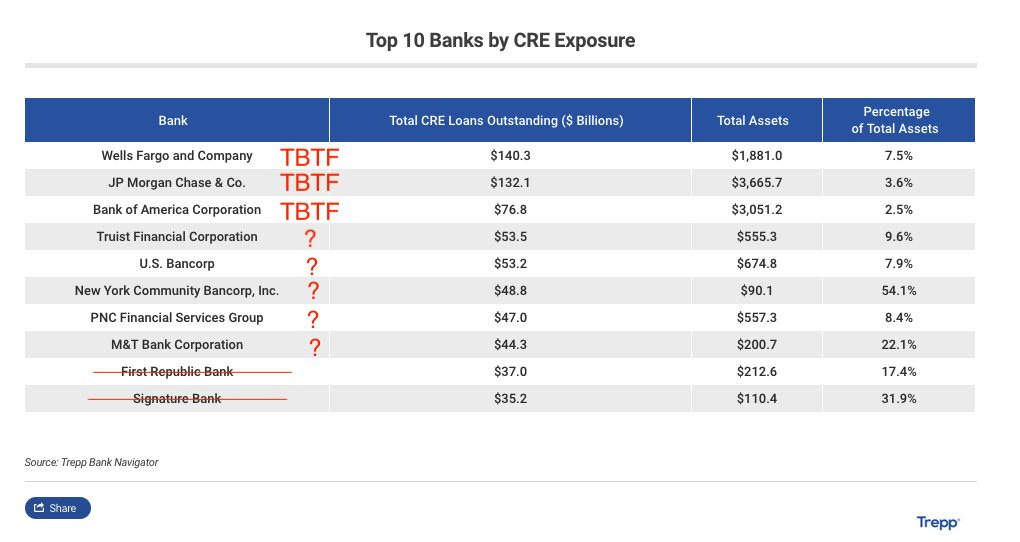

Another one bites the dust. First Republic Bank is the latest casualty of the Fed’s aggressive rate hikes and, after a slight short squeeze to prevent bears from getting too greedy on Monday, the rest of the banking sector has sold off rapidly today. If you thought this party was over, Joe is reinforcing that it is just getting started. These things take time to permeate through the archaic financial sector, as seen in every market crash in our nation’s history. Granted, the speed of emerging technology has allowed them to happen faster than before. That doesn’t change the general perception that 2 months in 2023 is almost a lifetime compared to the sloth pace of the 2008 financial crises that unfolded over the course of 2 years.

Tomorrow, Jerome Powell will come out and raise rates again. Any hope that the end is coming, and rates will pause or cut, is a fool’s dream.

First, as it relates to digital assets, the forensics have come in on the failures of Silicon Valley Bank and Signature Bank with the leading cause of their failures as a failure of oversight by regulators. That means the Federal Reserve and the FDIC. Who will hold them responsible? Only Congress can. Again, the finger pointed at digital assets was an obvious plot to further restrict innovation that could harm the current global unit of account and bolster the capacity of regulators to bring more credence to their agency. Entirely similar to how the Triad of the military expanded their own budgets to ensure their survival by conceiving ways to employ an infinitely expanding nuclear arsenal.

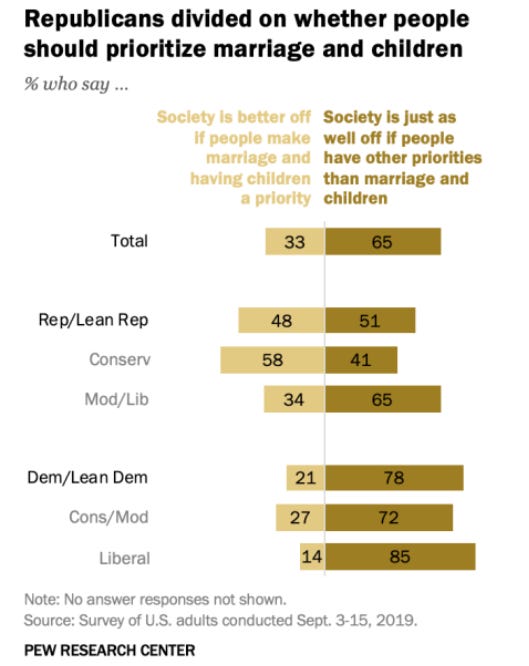

Second, can Congress agree on anything? I doubt it, as the only caveat to this is a new military conflict that could rally the country to a new common enemy and kick-start the military industrial complex, but then you have bigger worries than a domestic economic downturn. Congress has had a hard time with bipartisanship since a black man was elected president. The racial epithets rallied a base and created a new Civil War, a cold domestic war rallying in economics and class warfare since the push to nationalize the health care system started. If the debt ceiling isn’t raised and the US defaults on its debts, the only people that will be hurt are the electorate.

Tribalism among the two majority powers will then reach a fever pitch. It’s entirely predictable who is on which side. It’s not surprising that medical professionals became radical conservatives and teachers became screaming liberals. Red states and blue states are entrenched, with the swing states quickly becoming battlegrounds beyond the metaphorical sense of the word. Of course, there are other political ideologies, but the idea that anyone can entertain a shift of the big red and blue maps into something more gray is just as naive as the idea that the Fed isn’t trying to cause a recession.

2020 Electoral Maps:

Lastly, let me reinforce that the Fed is here to ensure that an economic downturn occurs and that these small banks consolidate into the Bank Term Funding Program’s large 8 beneficiaries that are TBTF (too big to fail), creating a blueprint for a nationalized banking system similar to what is seen in China. Fewer banks allow for more control, surveillance, and obfuscation of the financial system. The rate hikes will continue, the markets will sell off in a fantastic fashion as they have in 1907, 1929, 1987, 2008, 2010, and 2020. It remains to be seen if that pressure will coerce the bipartisanship deadlock into negotiations and the markets will find a quick bounce back as they have since the Federal Reserve left the gold standard. If the government doesn’t have the ability to print more money, then you can kiss your V-shaped reversal goodbye.

Does this mean Bitcoin goes to the moon while everything else crumbles? No. It will fall just as everything else does in a massive flight to liquidity. Maybe this would be different if you could pay your bills directly in Bitcoin, but there will be a fiat transfer from digital assets before the price stabilizes at a much higher market capitalization than sub $600,000,000,000. The advantage of Bitcoin is that it will reach a higher low than other assets due to its supply constraints. So to explicitly state what the playbook should be, selling into fiat and waiting to see if Congress can come to the rescue (if at all), and then buying digital assets at the moment that headline hits will be the move before inflation becomes a bigger boogeyman than economic depression, Civil War 2, or World War 3.

With legal battles on the horizon being underpinned by the Supreme Court’s recent decision to prohibit regulators from making enforcement actions in the absence of a Congressional ruling, the outlook for digital assets looks much more optimistic. The SEC will lose a fight in court if they suddenly become impotent in their blue-backed lawsuits against Ripple, the Grayscale Bitcoin Trust ETF conversion, and the Wells notices against Coinbase, who recently announced they will fight any enforcement in court. The biggest bright light for digital assets is that the red politicians have found a new in-route for gaining votes and have seized it to promote their free market agenda. Republicans grilled Gary Gensler for hours in his recent Senate hearing, and it’s obvious by his responses he was not prepared for the onslaught.

Plan on more banks failing. Plan on this election run-up becoming more volatile than ever before. Plan on chaos, because the tribes of the electorate are pointing the finger at each other when they should be banding together to question this new paradigm of nationalizing the banking system. The insurance that any portfolio is safe in the hands of the regulators is all too similar to what happened in 1987.